GM anon. Directly from Ghost Feed headquarters – we cut through the noise and deliver the alpha that matters, so you don't have to chase every pump.

Here's what we got for you today:

✍️ LOUD token launches with 60% crypto Twitter mindshare - attention farming goes mainstream

📈 Hyperliquid burns $120K while generating $3M in fees - the perp king keeps printing

🎯 GameStop drops $500M on Bitcoin while institutions pile in at record pace

✍️ Sui validators vote to make Cetus hack victims whole - chain governance in action

ATTENTION FARMING IS THE NEW YIELD FARMING 🧠

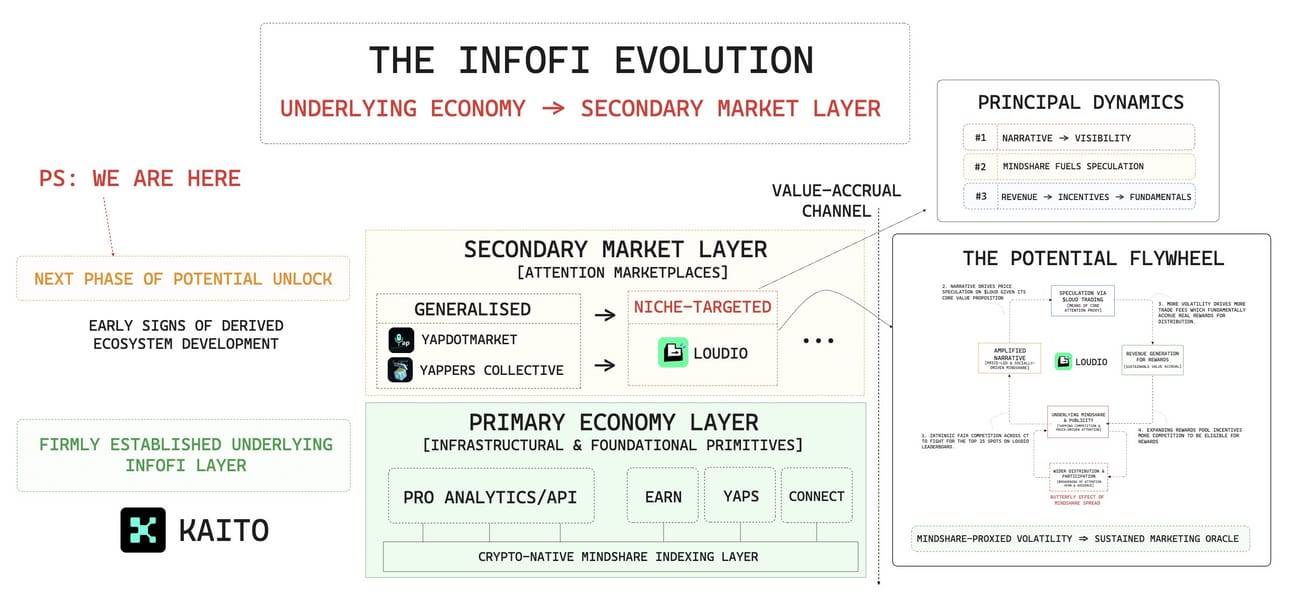

The LOUD token launch on May 31st isn't just another meme - it's the first tokenization of social media attention at scale. With 60% mindshare dominance across crypto Twitter and 72,000 unique visitors in 48 hours, this thing has captured something real.

Here's the mechanics: 4% trading fees get split 72% to top 25 content creators and 18% to KAITO stakers. At $10M weekly volume, top creators are looking at $10K+ weekly earnings just for posting quality content. The Initial Attention Offering raises 400 SOL for 45% of supply through HoloLaunch, with guaranteed access for top 1000 yappers.

But here's where it gets interesting - this isn't just about rewarding engagement farming. KAITO's AI actively penalizes direct solicitation while rewarding consistent, high-quality interactions. The system is designed to surface genuine influence, not bot networks.

The broader trend is clear: we're moving from DeFi summer to InfoFi winter. Projects like Cookie and Kaito are building the infrastructure to monetize attention and influence directly. When mindshare becomes tradeable, the game changes completely.

HYPERLIQUID KEEPS PRINTING WHILE OTHERS STRUGGLE 💰

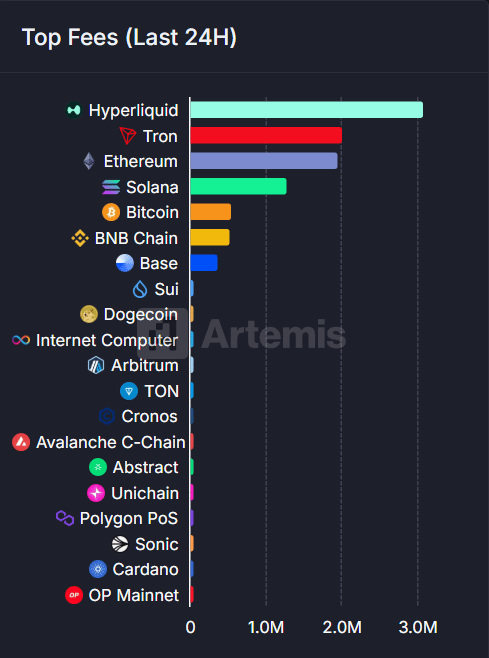

While most protocols are fighting for scraps, Hyperliquid just burned $120K in EVM fees while generating $3M in perp trading fees. Add another $40K burned for new listings, and you've got a deflationary machine that's actually making money.

The numbers tell the story: $66M in fees over the past 30 days, $800M annualized, all while operating with just 16 validators. That's not decentralization, but it's definitely efficiency. Platform TVL doubled to $1.46B in one month, securing the #10 spot by total value locked.

Bridge volume hit $240M with 60K users via deBridge, onboarding 18.2K new users. But here's the kicker - that's still less than 2% Ethereum user penetration. The runway for growth is massive.

Major exchanges are taking notice. Coinbase just launched HYPE perpetual futures, and Binance followed suit. When the big boys start offering your token, you know you've made it. The platform claims 80% market share of DeFi perpetuals - a bold claim, but the numbers back it up.

CORPORATE BITCOIN RESERVES HIT DIFFERENT 🏢

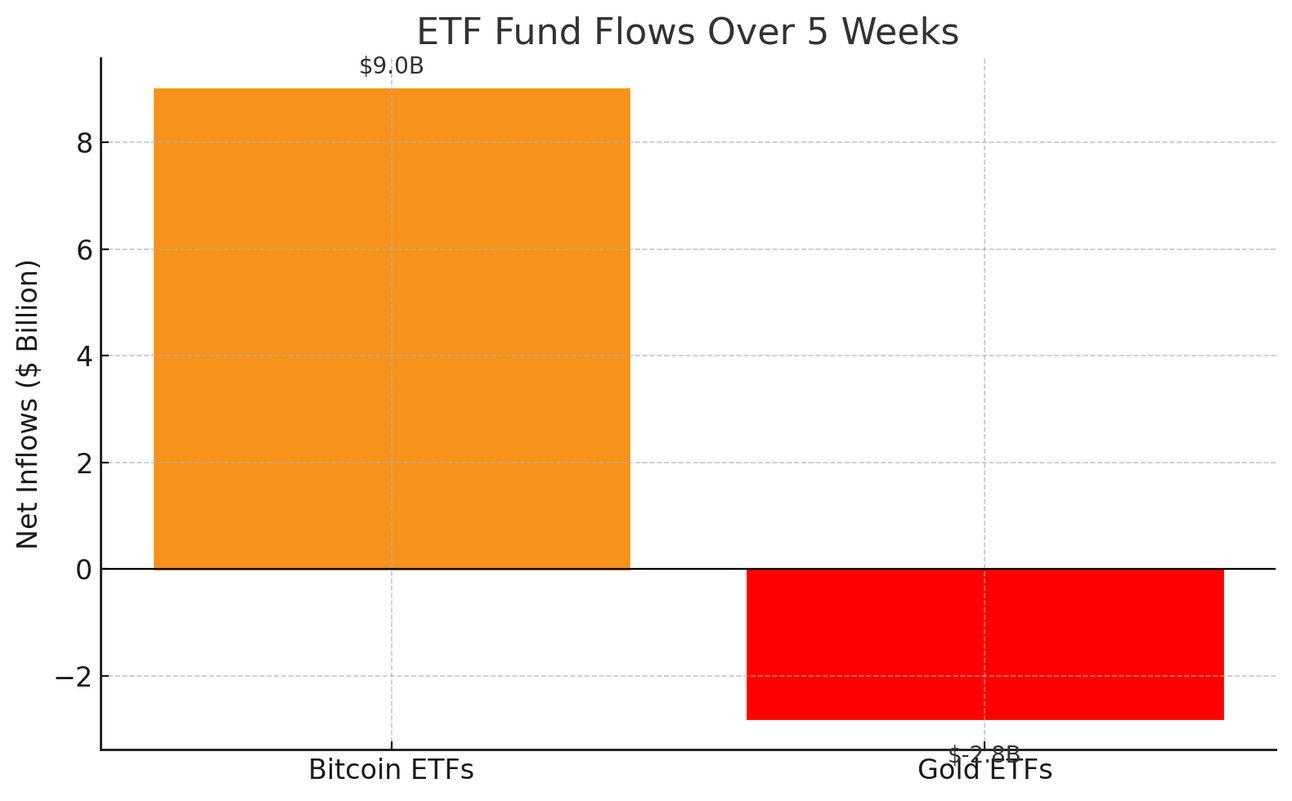

GameStop just dropped $500M on 4,710 Bitcoin, and the market barely blinked. That's how normalized corporate treasury adoption has become. But look deeper and you'll see the real story unfolding.

BlackRock's IBIT ranks as the 4th most traded ETF with $1.6B daily volume. They're absorbing Bitcoin at 10x the daily miner output while exchange supply hits 5-year lows. Meanwhile, Trump Media commits $2.5B for Bitcoin purchases, and Strive raises $750M specifically for BTC accumulation.

The institutional flow is relentless. Fidelity grabbed $38.3M in ETH, BlackRock added $50.4M, and ETF products recorded $91.9M in net inflows despite broader market weakness. This isn't retail FOMO - this is systematic institutional allocation.

Pakistan just committed to a Strategic Bitcoin Reserve with 2,000MW electricity for mining. The UK Reform Party announced their own Strategic Bitcoin Reserve bill. When nation-states start competing for Bitcoin, the supply shock becomes inevitable.

SUI SHOWS HOW CHAIN GOVERNANCE SHOULD WORK ⚖️

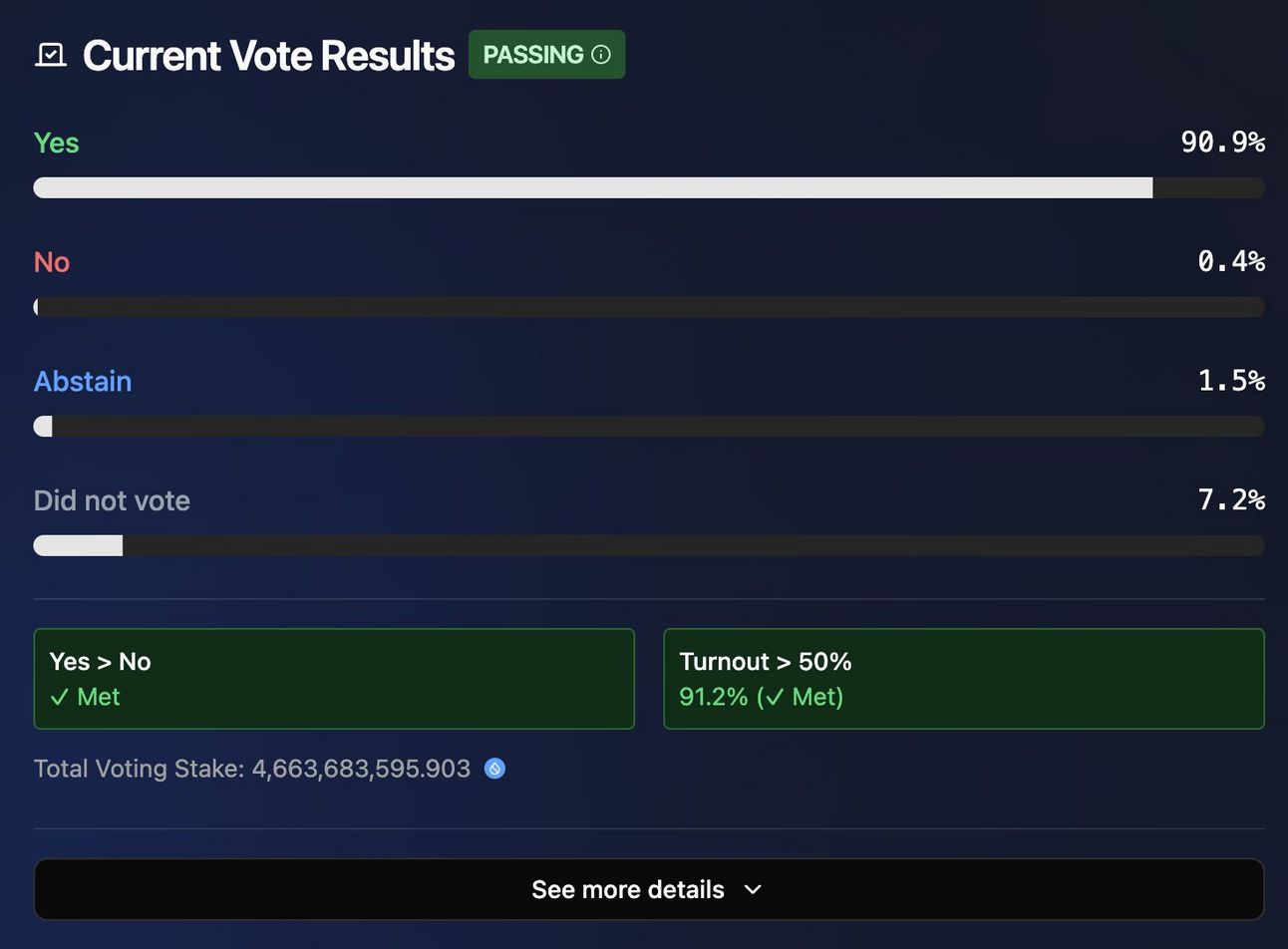

The Cetus Protocol exploit on Sui could have been another DeFi disaster story. Instead, it's becoming a case study in how chain governance should respond to hacks. Validator support for the fund recovery plan hit 81.5%, well above the initial 53% approval threshold.

Here's what's happening: the Sui Foundation secured a loan to enable full compensation for affected users, regardless of the community vote outcome. But the validators stepped up anyway, with 90.9% approval for the recovery plan. Funds will be secured in a multi-sig wallet pending user returns.

This isn't just about making users whole - it's about demonstrating that decentralized governance can actually work when it matters. Too many chains talk about community governance but fold when real decisions need to be made. Sui validators put their money where their mouth is.

The broader lesson: chain-level intervention capabilities exist, but using them responsibly builds trust rather than destroying it. When Cetus gets back to business, users will remember that the ecosystem had their back.

👻 That's a wrap 👻

The attention economy is getting tokenized, institutions are stacking sats at record pace, and Hyperliquid keeps printing while others struggle. Meanwhile, Sui just showed how chain governance should actually work when shit hits the fan.

LOUD launches tomorrow - watch the yappers become the new yield farmers.

Stay sharp,

Ghost Feed